Term Life Insurance Wikipedia A Term Life Insurance Policy Is The Simplest, Purest Form Of Life Insurance:

Term Life Insurance Wikipedia. Life Insurance (or Life Assurance, Especially In The Commonwealth Of Nations) Is A Contract Between An Insurance Policy Holder And An Insurer Or Assurer.

SELAMAT MEMBACA!

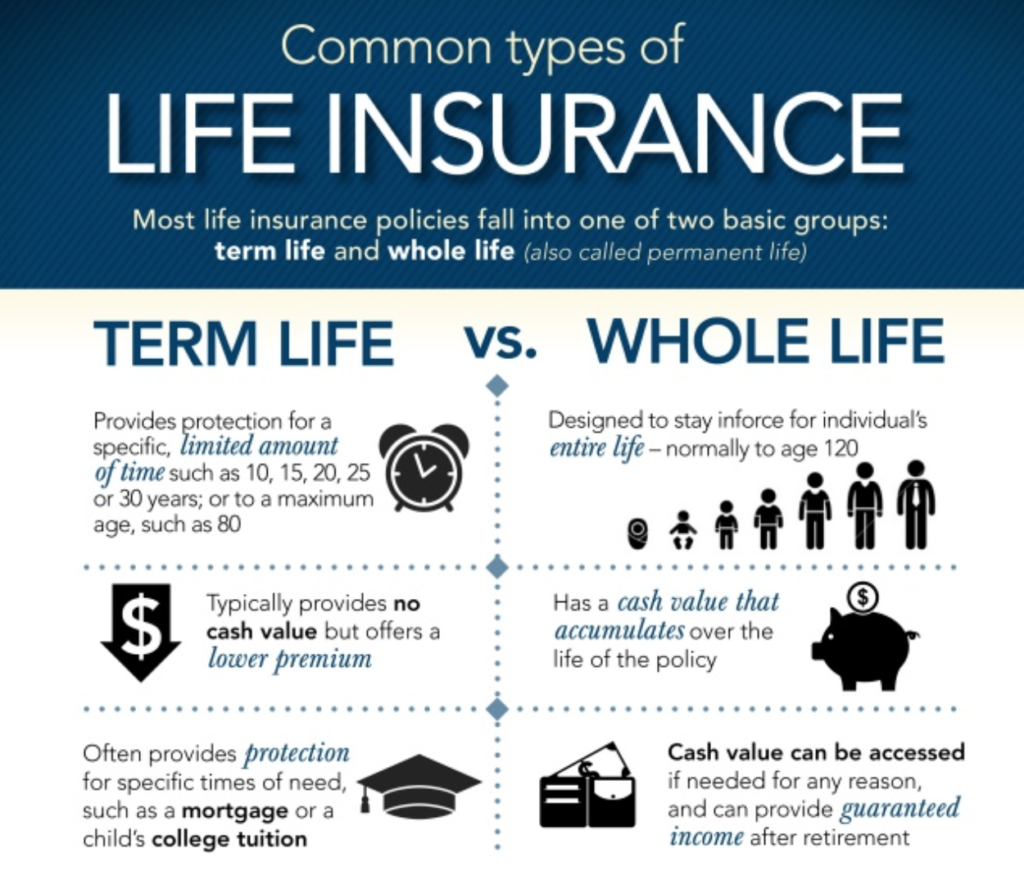

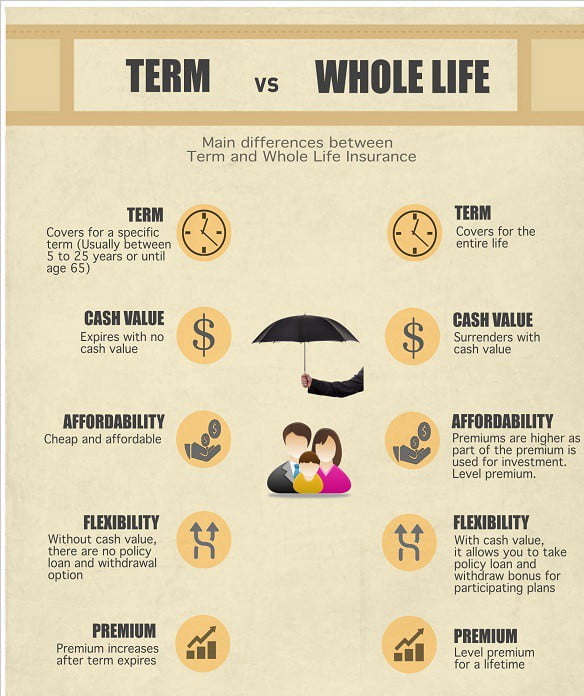

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance — life insurance for which premiums are paid over a limited time and that covers a specific term, the face value payable only if death occurs within that term.

Oviatt, economic place of insurance and its relation to society[1] life insurance is a… … wikipedia.

What is term life insurance?

The policy expires at the end of the term.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

At the end of your car lease, you.

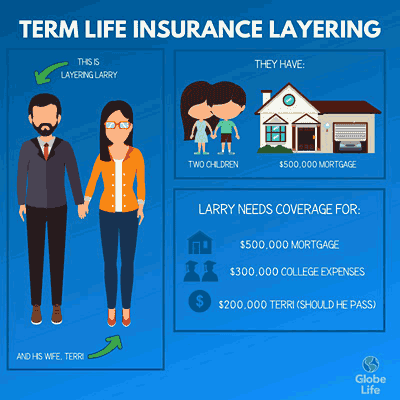

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would have to pay the mortgage on his or her own.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

Term length covers the policyholder for a specific amount of time.

10 to 30 years term lengths typically range from.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face.

These plans provide a pure life cover.

You take insurance cover for a limted period as per your needs, maybe upto 99 years age.

For lesser coverage duration, premium due decreses.

What is term life insurance?

You can choose the length of time you want, whether it be 1 year or 50 years.

A system in which you make regular payments to an insurance company in exchange for a fixed….

A contract that provides a death benefit but no cash build up or investment component.

The premium remains constant only for a specified term of years, and the policy is usually renewable at the end of each term.

Term life insurance — or term assurance is life insurance which provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance provides coverage for a set period of time, typically from five to 30 years.

The insurance company pays a benefit to your beneficiary if you die within this term.

What is supplemental life insurance?

Apply online and get a quote today.

You can also talk to a sun life financial advisor to learn more about term life insurance and how it can help you and your family.

Read on to learn more about it and how much it costs.

Our opinions are our own and are not influenced by payments.

Term life insurance policies are the most common.

With these policies, you pay a premium each month during a set term to secure a death benefit unlike term insurance, in which the death benefit is provided entirely by policy coverage, increasing cash value in a whole life policy decreases the.

Because the policyowner pays only for the cost of pure protection, term insurance premiums are smaller than premiums for permanent insurance for the same insured at the same issue age.

Unlike term life insurance, permanent life insurance is designed to cover you for life.

You won't have to worry about going without coverage in your later years or haven life offers term life insurance.

Term life insurance from fidelity is designed to provide financial resources to your family in the event of your death.

Learn which coverage options fit your why term life insurance makes sense.

If the worst were to happen to you.

Term life insurance is a very common form of life insurance and provides a lump sum payout if you die in the course of the policy duration or if you suffer from a total permanent disability.

Term insurance is a pure life insurance product, which provides financial protection to the policyholder.

In case of death of the insured during the policy period, the beneficiary receives a death benefit as defined under the chosen term insurance plan.

Whichever td term life insurance plan you choose, enjoy features like

Sehat Sekejap Dengan Es BatuTernyata Jangan Sering Mandikan BayiTekanan Darah Tinggi, Hajar Pakai Cincau Hijau5 Manfaat Posisi Viparita KaraniResep Alami Lawan Demam Anak4 Manfaat Minum Jus Tomat Sebelum Tidur6 Khasiat Cengkih, Yang Terakhir Bikin HebohAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Vitalitas Pria, Cukup Bawang Putih Saja7 Makanan Sebabkan SembelitTerm life insurance can provide coverage for 10 years, 20 years or for life depending on your needs. Term Life Insurance Wikipedia. Whichever td term life insurance plan you choose, enjoy features like

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance — life insurance for which premiums are paid over a limited time and that covers a specific term, the face value payable only if death occurs within that term.

Oviatt, economic place of insurance and its relation to society[1] life insurance is a… … wikipedia.

What is term life insurance?

The policy expires at the end of the term.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

At the end of your car lease, you.

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would have to pay the mortgage on his or her own.

Term length covers the policyholder for a specific amount of time.

10 to 30 years term lengths typically range from.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face.

These plans provide a pure life cover.

You take insurance cover for a limted period as per your needs, maybe upto 99 years age.

For lesser coverage duration, premium due decreses.

What is term life insurance?

You can choose the length of time you want, whether it be 1 year or 50 years.

A system in which you make regular payments to an insurance company in exchange for a fixed….

A contract that provides a death benefit but no cash build up or investment component.

The premium remains constant only for a specified term of years, and the policy is usually renewable at the end of each term.

Term life insurance — or term assurance is life insurance which provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance provides coverage for a set period of time, typically from five to 30 years.

The insurance company pays a benefit to your beneficiary if you die within this term.

What is supplemental life insurance?

Apply online and get a quote today.

You can also talk to a sun life financial advisor to learn more about term life insurance and how it can help you and your family.

Read on to learn more about it and how much it costs.

Our opinions are our own and are not influenced by payments.

Term life insurance policies are the most common.

With these policies, you pay a premium each month during a set term to secure a death benefit unlike term insurance, in which the death benefit is provided entirely by policy coverage, increasing cash value in a whole life policy decreases the.

Because the policyowner pays only for the cost of pure protection, term insurance premiums are smaller than premiums for permanent insurance for the same insured at the same issue age.

Unlike term life insurance, permanent life insurance is designed to cover you for life.

You won't have to worry about going without coverage in your later years or haven life offers term life insurance.

Term life insurance from fidelity is designed to provide financial resources to your family in the event of your death.

Learn which coverage options fit your why term life insurance makes sense.

If the worst were to happen to you.

Term life insurance is a very common form of life insurance and provides a lump sum payout if you die in the course of the policy duration or if you suffer from a total permanent disability.

Term insurance is a pure life insurance product, which provides financial protection to the policyholder.

In case of death of the insured during the policy period, the beneficiary receives a death benefit as defined under the chosen term insurance plan.

Whichever td term life insurance plan you choose, enjoy features like

Term life insurance can provide coverage for 10 years, 20 years or for life depending on your needs. Term Life Insurance Wikipedia. Whichever td term life insurance plan you choose, enjoy features likeStop Merendam Teh Celup Terlalu Lama!Foto Di Rumah Makan PadangPete, Obat Alternatif DiabetesResep Segar Nikmat Bihun Tom YamAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Pecel Pitik, Kuliner Sakral Suku Using Banyuwangi3 Jenis Daging Bahan Bakso TerbaikResep Kreasi Potato Wedges Anti GagalNikmat Kulit Ayam, Bikin SengsaraTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti

Comments

Post a Comment