Term Life Insurance Wikipedia These Plans Provide A Pure Life Cover.

Term Life Insurance Wikipedia. From The Older Form Ensurance, See Also Assurance.

SELAMAT MEMBACA!

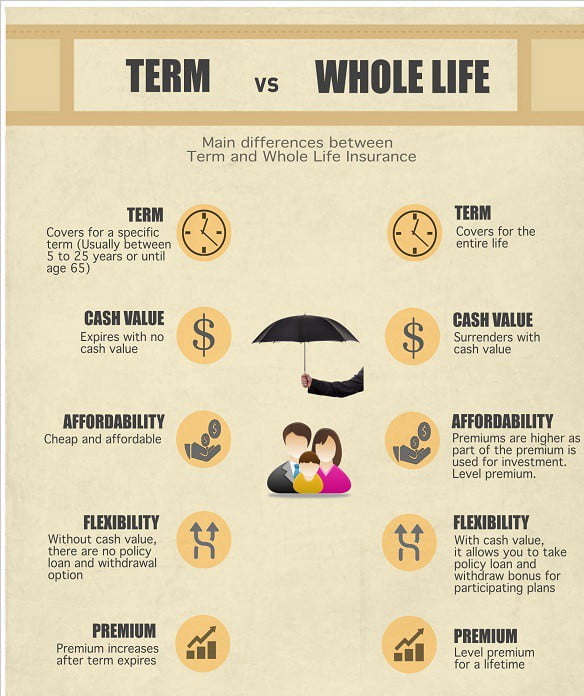

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

The policy expires at the end of the term.

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Term length covers the policyholder for a specific amount of time.

10 to 30 years term lengths typically range from.

Term life insurance pays out if the covered person dies within a set timeframe.

Learn how term life insurance works, including its pros and cons and alternatives.

The vast majority of term life insurance is level term, meaning the value of the benefit remains the same throughout the term.

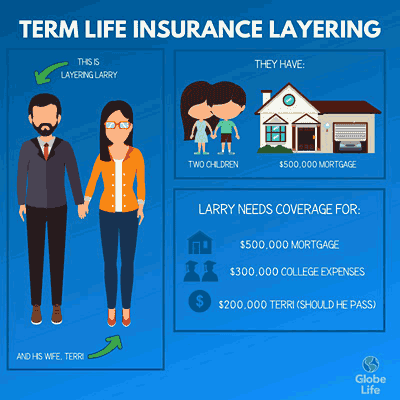

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would have to pay the mortgage on his or her own.

From the older form ensurance, see also assurance.

Term life insurance provides coverage for a set period of time, typically from five to 30 years.

What is supplemental life insurance?

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

At the end of your car lease, you.

A term insurance plan is a life insurance policy provided by insurance companies.

These plans provide a pure life cover.

For lesser coverage duration, premium due decreses.

A term life insurance policy is the simplest, purest form of life insurance:

Term life insurance is a top choice for people who want to cover financial obligations that are common when raising a family.

Some companies are venturing into longer terms of 35 and 40 years.

Protect your family with term life insurance.

Using zander insurance is the easiest and smartest way to give them peace of mind.

Term life insurance from fidelity is designed to provide financial resources to your family in the event of your death.

Learn which coverage options fit your why term life insurance makes sense.

If the worst were to happen to you.

Level term insurance — a life insurance policy with a fixed face value and increasing premiums.

A system in which you make regular payments to an insurance company in exchange for a fixed….

To simplify the text, we will present problems and relevant approaches in terms of a life insurance and annuity portfolio only.

This means that if you discover you need coverage for a longer period, you can convert your term.

What is term life insurance?

You can choose the length of time you want, whether it be 1 year or 50 years.

Sun life go simplified term life insurance.

Life insurance for $50,000, $75,000 or $100,000.

Monthly payments are guaranteed to stay the same for the first 10 years.

Read on to learn more about it and how much it costs.

Term life is pure insurance, with no cash value (or savings element) associated with it.

Because the policyowner pays only for the cost of pure protection, term insurance premiums are smaller than premiums for permanent insurance for the same insured at the same issue age.

Known also as pure life insurance, it is priced affordably so that anyone can apply for it at any life stage and with.

Protective life offers term life insurance that is both affordable with 10, 15, 20, 25 or 30 year policies to meet your needs.

Get your fast, free quote today.

Term life insurance from protective life offers more for your money — and we can prove it.

Term life insurance policies are the most common.

With these policies, you pay a premium each month during a set term to secure a death benefit unlike term insurance, in which the death benefit is provided entirely by policy coverage, increasing cash value in a whole life policy decreases the.

Average cost of life insurance by term length.

From wikipedia, the free encyclopedia.

Manfaat Kunyah Makanan 33 KaliGawat! Minum Air Dingin Picu Kanker!Cara Baca Tanggal Kadaluarsa Produk MakananAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ternyata Tidur Bisa Buat MeninggalMulti Guna Air Kelapa HijauMelawan Pikun Dengan ApelIni Efek Buruk Overdosis Minum KopiSaatnya Minum Teh Daun Mint!!Ternyata Merokok + Kopi Menyebabkan KematianFrom wikipedia, the free encyclopedia. Term Life Insurance Wikipedia. Term life insurance may be chosen in favor of permanent life insurance because term insurance is usually much less expensive[1] (depending on the length of the term), even if the applicant is an everyday smoker.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Max life insurance company limited (formerly known as max new york life insurance company limited) is a life insurance company in india with a joint venture (jv) between max india ltd and mitsui sumitomo insurance co ltd.

The company is a subsidiary of the publicly listed max financial.

Max life term plan with return of premium.

Life insurance acts no less than a lifeline for life, especially in the current uncertain times.

More people in india are gradually realising the.

Max life provides the jet claim settelemt option by settling claims in 24 hrs if the claim amount less than 25 lakhs.

Claims are promised to pay in 10 working days after receiving all the necessary documents from the nominee.

Max life insurance, gurgaon, haryana.

772,776 likes · 5,205 talking about this · 3,378 were here.

Max life insurance company offers different types of max term insurance plans in order to fulfill the requirements of the insurance seekers.

Max life super term plan.

Buy max life insurance with a wide range of products for your changing needs.

A term plan you can trust, with 99.22% claims paid ratio secure your family with max life smart secure plus plan.

Buy policy in just 2 mins.

2 lakh + happy customers.

Youtherealhello everyone in today's video you will get complete details of max life insurance company ltd in hindi|apart of this you will get the details of.

Последние твиты от max life insurance (@maxlifeins).

The official handle of max life insurance.

Start this innings of protection by discovering the real value for which you.

Max life insurance company was established in 2000 and started its operations during 2001 and is presently one of the leading names in the indian insurance industry.

At present it is the biggest life insurer among the privately held non banking companies of india.

Max life insurance term plan can be purchased up to the age of 60 years.

So, if you think it is too late for you to think about life insurance, fret not, you can still buy a life insurance and secure the future of people who are dependent on you.

Max insurance offers you a wide choice of income pay out options.

Enjoy guaranteed return of premiums, if the life insured outlives the policy term.

Life protection, wealth creation, retirement planning, secure future for max life insurance came into existence in the year 2000.

It was formerly known as max new york life insurance company limited.

Max life term insurance can continue to maintain your family's lifestyle by funding essential day to day expenditures and also achieve their life goal even in your absence.

Max life smart term plan.

^ on payment of additional premiums.

While the online plans are completely bereft of messy paperwork, the offline plans can be easily consulted with advisors and all three plans can be availed easily.

The policy helps the insured's family to cope with the rising cost of goods and services due to inflation.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

Many term policies offer level premiums for the.

Max life insurance reviews and complaints.

1800 200 5577;1800 corporate office max life insurance co.

10 to 30 years term lengths typically range from.

Depending on the type of policy, term life can offer fixed premiums for the entire term or life insurance on level terms.

The death benefits can be fixed.

The insurance company pays a benefit to your beneficiary if you die within this term.

How does term life insurance work?

What is supplemental life insurance?

The sale is being considered following the recentdecision by the indian cabinet to approve the proposal to raise foreign direct investment (fdi) inthe insurance sector to 49% from 26%.

Caring max new york life is redefining the life insurance paradigm by focusing on customers first.

The service process is responsive, personalized 13 life protector™ plus life protector™ plus provides you with a low cost insurance cover during its tenure of 5 years.

Max life term life insurance in hindi | max life smart term plan 2020.

Max life has approximately 2,00,000 life insurance customers in india.

Max life has approximately 2,00,000 life insurance customers in india. Term Life Insurance Wikipedia. Its distribution channel includes banks, individual agents, brokers, and corporate agents, among others.3 Jenis Daging Bahan Bakso TerbaikWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Stawberry Cheese Thumbprint CookiesTips Memilih Beras Berkualitas5 Trik Matangkan ManggaResep Ayam Suwir Pedas Ala CeritaKulinerBir Pletok, Bir Halal BetawiCegah Alot, Ini Cara Benar Olah Cumi-CumiSusu Penyebab Jerawat???Resep Selai Nanas Homemade

Comments

Post a Comment