Life Insurance Wiki English Yes, Whole Life Insurance Has Been Around Much Longer, But When It Comes To Financial Needs Like Replacing Your Income, Paying Off A Mortgage, Or Making Sure Your When We Consider What Level Term Insurance Is, We Should First Acknowledge That There Is More Than One Kind Of Term Life Insurance.

Life Insurance Wiki English. Our Glossary Of Life Insurance Terms Provides Detailed Definitions Of Common Terms You Will Encounter During The Life Insurance Application Process.

SELAMAT MEMBACA!

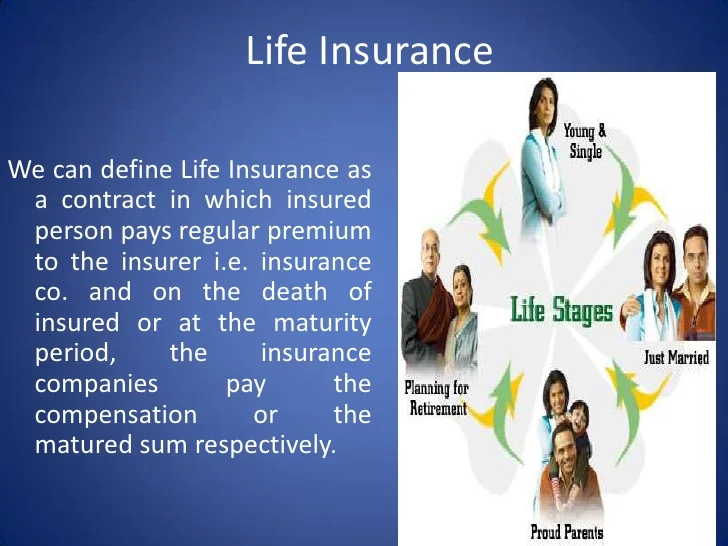

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Life insurance corporation of india (abbreviated as lic) is an indian government owned insurance and investment corporation.

The life insurance corporation of india was established on september.

A form of insurance on the life of a person.

If the person dies then the insurance policy pays out a sum of money to the beneficiary (such as a person's family).

Life insurance is part of estate planning.

A life insurance policy allows your beneficiaries to cover their living expenses after your death.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium, upon the death of an insured.

Life insurance is the fifth episode of the first season of netflix series who killed sara?.

.jpg)

Elisa and álex attend a masquerade party at the casino.

Manolo cardona as álex guzmán.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Life insurance is a form of insurance in which a person makes regular payments to an.

| life insurance in british english.

Another name for life assurance.

לעבן פארזיכערוג, לייף אינשורענס (yi);

���ाइफ इन् शुरन् स (mr);

Ablebensversicherung, erlebensversicherung, nace 65.11 (de);

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Our glossary of life insurance terms provides detailed definitions of common terms you will encounter during the life insurance application process.

Life insurance (or commonly life assurance, especially in the commonwealth) is a contract between an insured (insurance policy holder) and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefits) in exchange for a premium, upon the death of.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

Life insurance meaning, definition, what is life insurance:

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what life cover to be eligible for hsbc life insurance products:

You must be a uk resident (not including the channel islands or the isle of man).

Life insurance 101 life insurance 101 pdf life insurance 101 video life insurance 101 basics life insurance 101 powerpoint life insurance 101 presentation life insurance 101 canada life insurance 1.

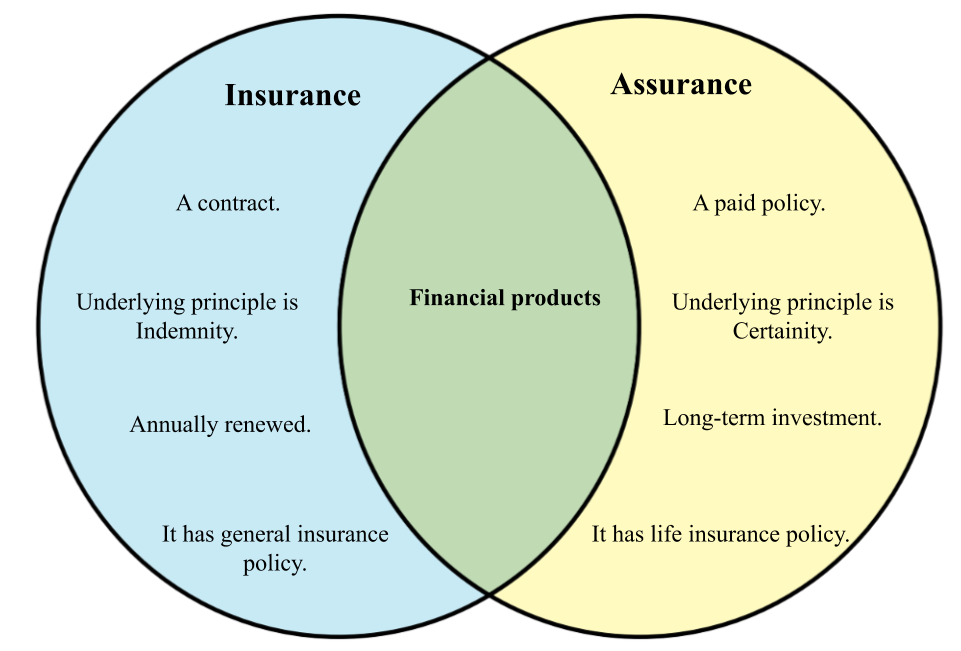

Many people assume that life insurance and life assurance are the same thing, when in fact there are differences between these two types of policy.

Here we explain how life insurance and life assurance work, to help you decide which might be right for you.

![[PDF] Insurance Awareness PDF Download in English - InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/insurance-awareness-pdf-pdf-344.jpg)

Life insurance synonyms, life insurance pronunciation, life insurance translation, english dictionary definition of life insurance.

Life insurance refers to a contract between the insured and the insurer, where the latter agrees to pay a beneficiary a specific amount of money upon the death of the insured.

Term insurance is the simplest form of life insurance available in the market.

Protect your family by having life insurance coverage.

This article will answer some of the most frequently asked questions regarding life insurance.

First, here are some of the most common terms relating to life insurance, explained in super easy to read format.

How much and for how long?

With so many different types of life insurance out there my hope is to basically life insurance that is effective for a certain amount of years from 1 to 5 to 20 to 30 years.

Nowadays you can find some insurance companies.

Forums pour discuter de life insurance, voir ses formes composées, des exemples et poser vos i bought life insurance to help my family if something happens to me.

Savesave shriram life insurance company (wiki) for later.

50%(2)50% found this document useful (2 votes).

![[PDF] Max Life Insurance Platinum Wealth Plan Leaflet PDF ...](https://instapdf.in/wp-content/uploads/pdf-thumbnails/max-life-insurance-platinum-wealth-plan-leaflet-1697.jpg)

Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

For example, if you earn $75.

When you purchase a life insurance policy, you'll be given the option of designating one or multiple beneficiaries to receive a death benefit in the case you pass away.

Aside from minors, insurers don't have rules on who you name as a beneficiary.

Cara Benar Memasak SayuranTernyata Madu Atasi InsomniaMengusir Komedo Membandel - Bagian 25 Khasiat Buah Tin, Sudah Teruji Klinis!!3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Tertawa Itu DukaTernyata Tidur Bisa Buat MeninggalKhasiat Luar Biasa Bawang Putih PanggangMulai Sekarang, Minum Kopi Tanpa Gula!!Manfaat Kunyah Makanan 33 KaliChoosing a life insurance beneficiary. Life Insurance Wiki English. Aside from minors, insurers don't have rules on who you name as a beneficiary.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Life insurance corporation of india (abbreviated as lic) is an indian government owned insurance and investment corporation.

The life insurance corporation of india was established on september.

A form of insurance on the life of a person.

If the person dies then the insurance policy pays out a sum of money to the beneficiary (such as a person's family).

Life insurance is part of estate planning.

A life insurance policy allows your beneficiaries to cover their living expenses after your death.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium, upon the death of an insured.

Life insurance is the fifth episode of the first season of netflix series who killed sara?.

Elisa and álex attend a masquerade party at the casino.

Manolo cardona as álex guzmán.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Life insurance is a form of insurance in which a person makes regular payments to an.

| life insurance in british english.

Another name for life assurance.

לעבן פארזיכערוג, לייף אינשורענס (yi);

���ाइफ इन् शुरन् स (mr);

Ablebensversicherung, erlebensversicherung, nace 65.11 (de);

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Our glossary of life insurance terms provides detailed definitions of common terms you will encounter during the life insurance application process.

Life insurance (or commonly life assurance, especially in the commonwealth) is a contract between an insured (insurance policy holder) and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefits) in exchange for a premium, upon the death of.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

Life insurance meaning, definition, what is life insurance:

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what life cover to be eligible for hsbc life insurance products:

You must be a uk resident (not including the channel islands or the isle of man).

Life insurance 101 life insurance 101 pdf life insurance 101 video life insurance 101 basics life insurance 101 powerpoint life insurance 101 presentation life insurance 101 canada life insurance 1.

Many people assume that life insurance and life assurance are the same thing, when in fact there are differences between these two types of policy.

Here we explain how life insurance and life assurance work, to help you decide which might be right for you.

Life insurance synonyms, life insurance pronunciation, life insurance translation, english dictionary definition of life insurance.

Life insurance refers to a contract between the insured and the insurer, where the latter agrees to pay a beneficiary a specific amount of money upon the death of the insured.

Term insurance is the simplest form of life insurance available in the market.

Protect your family by having life insurance coverage.

This article will answer some of the most frequently asked questions regarding life insurance.

First, here are some of the most common terms relating to life insurance, explained in super easy to read format.

How much and for how long?

With so many different types of life insurance out there my hope is to basically life insurance that is effective for a certain amount of years from 1 to 5 to 20 to 30 years.

Nowadays you can find some insurance companies.

Forums pour discuter de life insurance, voir ses formes composées, des exemples et poser vos i bought life insurance to help my family if something happens to me.

Savesave shriram life insurance company (wiki) for later.

50%(2)50% found this document useful (2 votes).

Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

For example, if you earn $75.

When you purchase a life insurance policy, you'll be given the option of designating one or multiple beneficiaries to receive a death benefit in the case you pass away.

Aside from minors, insurers don't have rules on who you name as a beneficiary.

Choosing a life insurance beneficiary. Life Insurance Wiki English. Aside from minors, insurers don't have rules on who you name as a beneficiary.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Ikan Tongkol Bikin Gatal? Ini PenjelasannyaTernyata Kue Apem Bukan Kue Asli Indonesia5 Trik Matangkan ManggaResep Selai Nanas HomemadeResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Yakitori, Sate Ayam Ala JepangKuliner Jangkrik Viral Di JepangSejarah Gudeg JogyakartaKhao Neeo, Ketan Mangga Ala Thailand

Comments

Post a Comment