Canada Life Insurance Wikipedia This Means You'd Get A Cash Value Back (less Than The Amount You Paid In Premiums For The Insurance Costs) If You Cancel Your Policy.

Canada Life Insurance Wikipedia. Canada Life Insurance Products Are Available For Purchase In All Parts Of Canada.

SELAMAT MEMBACA!

The canada life assurance company, commonly known as canada life, is an insurance and financial services company with its headquarters in winnipeg, manitoba.

Jump to navigation jump to search.

–� sun life financial (6 p).

Pages in category life insurance companies of canada.

It is primarily known as a life insurance company.

It is one of the largest life insurance companies in the world.

For the best experience, please update to a modern browser.

Permanent life insurance policies build up a cash value.

This means you'd get a cash value back (less than the amount you paid in premiums for the insurance costs) if you cancel your policy.

At sun life, we help our clients achieve lifetime financial security and live healthier, happier lives.

Plus, our advisors are here to help you meet your financial goals and needs.

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary (or the estate) a sum of money (the benefits or face value) upon the death of the insured person.

Canada life insurance products are available for purchase in all parts of canada.

Canada life's main product offerings include life, critical illness, disability and business insurance.

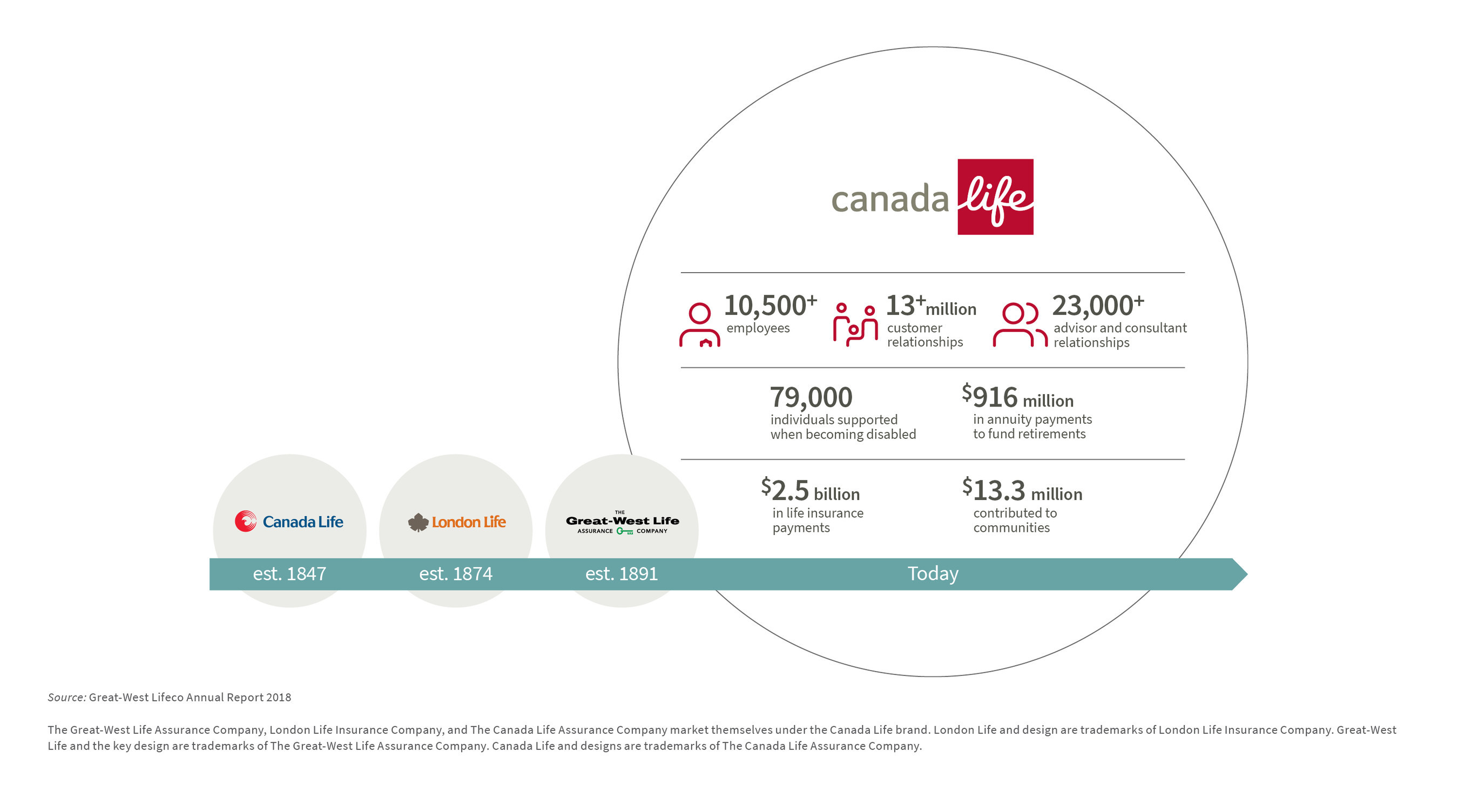

Canada life was founded in 1847 and now.

Canada life offers term life insurance for canadians.

Founded in 1847, canada life was the first domestic life insurance company in canada.

The company's strong capitalization and diverse insurance offerings.

We offer different types of life insurance including term insurance, permanent insurance and insurance for children.

As life changes, insurance needs can change too.

Life insurance is a way to help ensure that your family's financial future will be protected.

230 likes · 1 talking about this.

Term life and permanent life insurance.

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Coverme® travel insurance for visitors to canada.

A subsidiary of insurance supermarket inc., one of canada's largest insurance brokerages, this platform allows users to calculate their coverage needs, compare life insurance plans, and request quotes online.

An instant life representative will then compare rates with more than 20 of canada's.

Thank you life insurance canada for ensuring i received the best pricing and coverage.

I am new to canada and found them online and was pleasantly surprised with the ease of use and enjoyed my correspondence with their team.

Thanks for making sure i'm taken care of.

Get a free online quote in 15 seconds and explore life insurance is a great way of investing a part of your capital in your loved ones' future!

Find a plan that suits your personal needs to leave a legacy.

How much does life insurance cost in canada?

This policyme review covers its features, benefits, downsides, and whether it is legit.

Your best guide to canada life insurance companies.

In canada life insurance is available for a huge range of requirements.

Why do i need life insurance? if you need to ask, then you know why.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Equitable life insurance of canada has one goal in mind:

The satisfaction of their clients.

This insurance company sells attractive life insurance and investment products.

Submitted 2 years ago by my husband and i are looking into getting life insurance as we have a little one now but both of us are that being said;

Compare life insurance quotes & explore your coverage options.

Compare cheap life insurance quotes.

We are building better futures in the uk through our wealth, insurance and asset management solutions.

Canada life international limited and cli institutional limited are isle of man registered companies authorised and regulated by the isle of man financial services authority.

There are many life insurance companies available in canada for 2020 that offer various types of insurance plans that can be perfect for you.

The company offers its customer's customized services and financial security.

#lifeinsurance101 #lifeinsuranceincanada #howinsuranceworks how life insurance works in canada | insurance 101 let's face it!

Some canadian insurance brokers are the allstate insurance company of canada, assumption life and aviva canada.

Learn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations.

We offer home, life, and auto insurance as well as online banking and.

Mulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Tidur Terbaik Cukup 2 Menit!Awas, Bibit Kanker Ada Di Mobil!!Resep Alami Lawan Demam AnakPentingnya Makan Setelah OlahragaGawat! Minum Air Dingin Picu Kanker!Awas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Madu Atasi InsomniaKhasiat Luar Biasa Bawang Putih PanggangTernyata Tidur Bisa Buat MeninggalLearn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations. Canada Life Insurance Wikipedia. We offer home, life, and auto insurance as well as online banking and.

The canada life assurance company, commonly known as canada life, is an insurance and financial services company with its headquarters in winnipeg, manitoba.

Jump to navigation jump to search.

–� sun life financial (6 p).

Pages in category life insurance companies of canada.

It is primarily known as a life insurance company.

It is one of the largest life insurance companies in the world.

For the best experience, please update to a modern browser.

Permanent life insurance policies build up a cash value.

This means you'd get a cash value back (less than the amount you paid in premiums for the insurance costs) if you cancel your policy.

At sun life, we help our clients achieve lifetime financial security and live healthier, happier lives.

Plus, our advisors are here to help you meet your financial goals and needs.

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary (or the estate) a sum of money (the benefits or face value) upon the death of the insured person.

Canada life insurance products are available for purchase in all parts of canada.

Canada life's main product offerings include life, critical illness, disability and business insurance.

Canada life was founded in 1847 and now.

Canada life offers term life insurance for canadians.

Founded in 1847, canada life was the first domestic life insurance company in canada.

The company's strong capitalization and diverse insurance offerings.

We offer different types of life insurance including term insurance, permanent insurance and insurance for children.

As life changes, insurance needs can change too.

Life insurance is a way to help ensure that your family's financial future will be protected.

230 likes · 1 talking about this.

Term life and permanent life insurance.

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Coverme® travel insurance for visitors to canada.

A subsidiary of insurance supermarket inc., one of canada's largest insurance brokerages, this platform allows users to calculate their coverage needs, compare life insurance plans, and request quotes online.

An instant life representative will then compare rates with more than 20 of canada's.

Thank you life insurance canada for ensuring i received the best pricing and coverage.

I am new to canada and found them online and was pleasantly surprised with the ease of use and enjoyed my correspondence with their team.

Thanks for making sure i'm taken care of.

Get a free online quote in 15 seconds and explore life insurance is a great way of investing a part of your capital in your loved ones' future!

Find a plan that suits your personal needs to leave a legacy.

How much does life insurance cost in canada?

This policyme review covers its features, benefits, downsides, and whether it is legit.

Your best guide to canada life insurance companies.

In canada life insurance is available for a huge range of requirements.

Why do i need life insurance? if you need to ask, then you know why.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Equitable life insurance of canada has one goal in mind:

The satisfaction of their clients.

This insurance company sells attractive life insurance and investment products.

Submitted 2 years ago by my husband and i are looking into getting life insurance as we have a little one now but both of us are that being said;

Compare life insurance quotes & explore your coverage options.

Compare cheap life insurance quotes.

We are building better futures in the uk through our wealth, insurance and asset management solutions.

Canada life international limited and cli institutional limited are isle of man registered companies authorised and regulated by the isle of man financial services authority.

There are many life insurance companies available in canada for 2020 that offer various types of insurance plans that can be perfect for you.

The company offers its customer's customized services and financial security.

#lifeinsurance101 #lifeinsuranceincanada #howinsuranceworks how life insurance works in canada | insurance 101 let's face it!

Some canadian insurance brokers are the allstate insurance company of canada, assumption life and aviva canada.

Learn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations.

We offer home, life, and auto insurance as well as online banking and.

Learn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations. Canada Life Insurance Wikipedia. We offer home, life, and auto insurance as well as online banking and.Resep Cream Horn PastryPete, Obat Alternatif DiabetesSejarah Kedelai Menjadi TahuKhao Neeo, Ketan Mangga Ala ThailandIni Beda Asinan Betawi & Asinan Bogor5 Cara Tepat Simpan TelurTernyata Bayam Adalah Sahabat WanitaStop Merendam Teh Celup Terlalu Lama!Ternyata Kue Apem Bukan Kue Asli IndonesiaTernyata Jajanan Pasar Ini Punya Arti Romantis

Comments

Post a Comment