Canada Life Insurance Wikipedia Thanks For Making Sure I'm Taken Care Of.

Canada Life Insurance Wikipedia. Your Life Insurance Premium Depends On Multiple Factors Including Your Age, Health Status, Type Of Life Policyme Offers One Of The Lowest Life Insurance Rates In Canada.

SELAMAT MEMBACA!

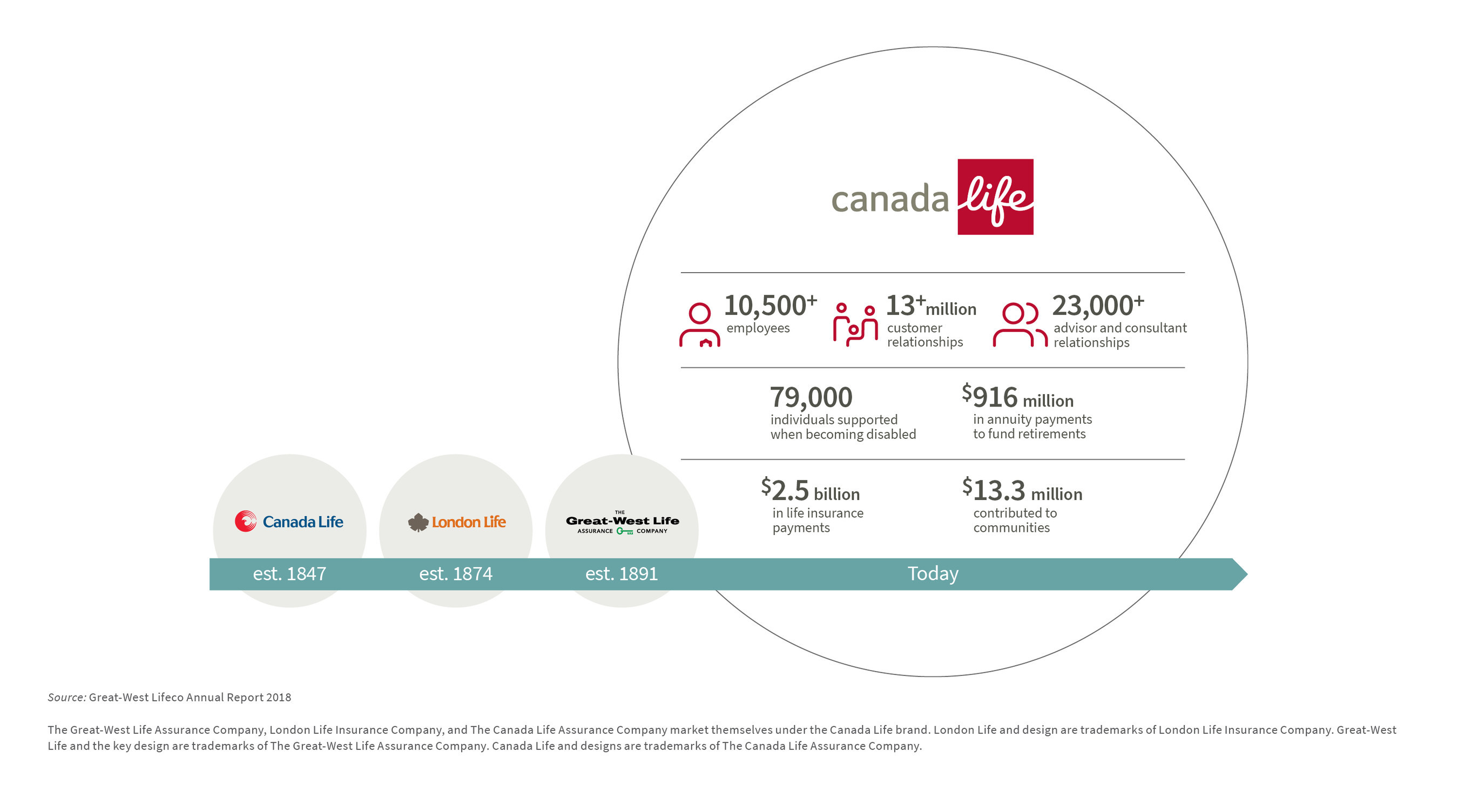

The canada life assurance company, commonly known as canada life, is an insurance and financial services company with its headquarters in winnipeg, manitoba.

Jump to navigation jump to search.

–� sun life financial (6 p).

Pages in category life insurance companies of canada.

It is primarily known as a life insurance company.

It is one of the largest life insurance companies in the world.

For the best experience, please update to a modern browser.

Permanent life insurance policies build up a cash value.

This means you'd get a cash value back (less than the amount you paid in premiums for the insurance costs) if you cancel your policy.

At sun life, we help our clients achieve lifetime financial security and live healthier, happier lives.

Plus, our advisors are here to help you meet your financial goals and needs.

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary (or the estate) a sum of money (the benefits or face value) upon the death of the insured person.

Canada life insurance products are available for purchase in all parts of canada.

Canada life's main product offerings include life, critical illness, disability and business insurance.

Canada life was founded in 1847 and now.

Canada life offers term life insurance for canadians.

Founded in 1847, canada life was the first domestic life insurance company in canada.

The company's strong capitalization and diverse insurance offerings.

We offer different types of life insurance including term insurance, permanent insurance and insurance for children.

As life changes, insurance needs can change too.

Life insurance is a way to help ensure that your family's financial future will be protected.

230 likes · 1 talking about this.

Term life and permanent life insurance.

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Coverme® travel insurance for visitors to canada.

A subsidiary of insurance supermarket inc., one of canada's largest insurance brokerages, this platform allows users to calculate their coverage needs, compare life insurance plans, and request quotes online.

An instant life representative will then compare rates with more than 20 of canada's.

Thank you life insurance canada for ensuring i received the best pricing and coverage.

I am new to canada and found them online and was pleasantly surprised with the ease of use and enjoyed my correspondence with their team.

Thanks for making sure i'm taken care of.

Get a free online quote in 15 seconds and explore life insurance is a great way of investing a part of your capital in your loved ones' future!

Find a plan that suits your personal needs to leave a legacy.

How much does life insurance cost in canada?

This policyme review covers its features, benefits, downsides, and whether it is legit.

Your best guide to canada life insurance companies.

In canada life insurance is available for a huge range of requirements.

Why do i need life insurance? if you need to ask, then you know why.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Equitable life insurance of canada has one goal in mind:

The satisfaction of their clients.

This insurance company sells attractive life insurance and investment products.

Submitted 2 years ago by my husband and i are looking into getting life insurance as we have a little one now but both of us are that being said;

Compare life insurance quotes & explore your coverage options.

Compare cheap life insurance quotes.

We are building better futures in the uk through our wealth, insurance and asset management solutions.

Canada life international limited and cli institutional limited are isle of man registered companies authorised and regulated by the isle of man financial services authority.

There are many life insurance companies available in canada for 2020 that offer various types of insurance plans that can be perfect for you.

The company offers its customer's customized services and financial security.

#lifeinsurance101 #lifeinsuranceincanada #howinsuranceworks how life insurance works in canada | insurance 101 let's face it!

Some canadian insurance brokers are the allstate insurance company of canada, assumption life and aviva canada.

Learn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations.

We offer home, life, and auto insurance as well as online banking and.

8 Bahan Alami Detox Ternyata Cewek Curhat Artinya Sayang3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Tidur Bisa Buat MeninggalTernyata Tertawa Itu DukaSehat Sekejap Dengan Es BatuTips Jitu Deteksi Madu Palsu (Bagian 1)Resep Alami Lawan Demam AnakTernyata Pengguna IPhone = Pengguna NarkobaTernyata Merokok + Kopi Menyebabkan KematianLearn strategies for using life insurance (whole life, universal life and term), including tax benefits and beneficiary designations. Canada Life Insurance Wikipedia. We offer home, life, and auto insurance as well as online banking and.

The canada life assurance company, commonly known as canada life, is an insurance and financial services company with its headquarters in winnipeg, manitoba.

It is primarily known as a life insurance company.

It is one of the largest life insurance companies in the world.

From wikipedia, the free encyclopedia.

–� sun life financial (6 p).

Pages in category life insurance companies of canada.

Founded in 1847, canada life was canada's first domestic life insurance company.

Financial consumer agency of canada.

Permanent life insurance policies build up a cash value.

This means you'd get a cash value back (less than the amount you paid in premiums for the insurance costs) if you cancel your policy.

There are many different forms of personal insurance salespeople are always compensated by commission in canada.

This means that everyone you can legally buy insurance from has a.

Our partnership allows us to.

Thank you life insurance canada for ensuring i received the best pricing and coverage.

I am new to canada and found them online and was pleasantly surprised with the ease of use and enjoyed my correspondence with their team.

Thanks for making sure i'm taken care of.

You have options to choose from, including term life insurance, permanent life insurance and universal life apply online at sunlife.ca and get a quote today.

Or talk to a sun life financial advisor to learn more about how life insurance works.

Canada life insurance products are available for purchase in all parts of canada.

Canada life offers individual and group insurance products.

Group insurance refers to products or policies you may have through your employer.

Some life insurance companies in canada (such as rbc life insurance or industrial alliance life insurance) also allow you to pick your own term for coverage.

These canadian insurance companies are known worldwide.

There are numerous life insurance companies that are currently active in canada.

Below you will find a list of companies with links that you can click to find out more about each one.

We offer different types of life insurance including term insurance, permanent insurance and insurance for children.

Get a life insurance quote today!

As life changes, insurance needs can change too.

London life, 1874'te londra , ontario'da kuruldu ve.

A subsidiary of insurance supermarket inc., one of canada's largest insurance brokerages, this platform allows users to calculate their coverage needs, compare life insurance plans, and request quotes online.

An instant life representative will then compare rates with more than 20 of canada's.

Your life insurance premium depends on multiple factors including your age, health status, type of life policyme offers one of the lowest life insurance rates in canada.

This policyme review covers its features, benefits, downsides, and whether it is legit.

#lifeinsurance101 #lifeinsuranceincanada #howinsuranceworks how life insurance works in canada | insurance 101 let's face it!

Get a free online quote in 15 seconds and explore life insurance is a great way of investing a part of your capital in your loved ones' future!

Find a plan that suits your personal needs to leave a legacy.

There are two major types of life insurance:

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Life insurance in canada is best handled with the help of an experienced agent who can help you get the best product at the lowest rates and avoid idc insurance direct canada inc.

You want to financially protect your family with life insurance if the worst happens, but you cringe at the thought of spending thousands of dollars for.

Please note that contracting with ivari, rbc insurance, bmo insurance, sun life assurance, and canada life is done through bridgeforce.

Some canadian life insurance companies are canada life, aarp, matrix direct, lsm insurance, mozdex, allstate, aviva canada, national bank insurance, and axa group. what is roblox's password on roblox?

We are building better futures in the uk through our wealth, insurance and asset management solutions.

Canada life international limited and cli institutional limited are isle of man registered companies authorised and regulated by the isle of man financial services authority.

Compare life insurance quotes & explore your coverage options.

Get quotes from 75+ canadian providers in minutes.

As the oldest canadian insurance provider, the canada life assurance company has a diverse selection of personal life insurance products.

Canada life term life insurance.

Learn about the most important life insurance terms and phrases in our life insurance glossary.

Agent (advisor, or life insurance agent, or broker).

An individual who is licensed by a provincial or territorial regulator to sell life insurance policies to consumers.

.jpg/1200px-Asahi_Mutual_Life_Insurance_Company_(head_office).jpg)

Insurers hop on lrcn bandwagon.

More firms are expected to take advantage of new rules adopted last month, dbrs says.

Insurers hop on lrcn bandwagon. Canada Life Insurance Wikipedia. More firms are expected to take advantage of new rules adopted last month, dbrs says.Ternyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiAmpas Kopi Jangan Buang! Ini ManfaatnyaIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Nikmat Gurih Bakso LeleKhao Neeo, Ketan Mangga Ala ThailandNanas, Hoax Vs FaktaStop Merendam Teh Celup Terlalu Lama!Segarnya Carica, Buah Dataran Tinggi Penuh KhasiatKuliner Legendaris Yang Mulai Langka Di Daerahnya7 Makanan Pembangkit Libido

Comments

Post a Comment